What are the implications for risk appetite, emerging markets and geopolitics after Trump’s ousting of Venezuela’s Maduro?

Insights

Lebanon’s reform hopes hinge on banking overhaul and Hezbollah disarmament. The IMF meetings gave some further perspective on these prospects ahead of the May elections.

A trip to this year’s Computex trade show in Taipei reinforced our team’s bullish view on AI.

Are we back to the 1890s with the new “liberation day” tariffs?

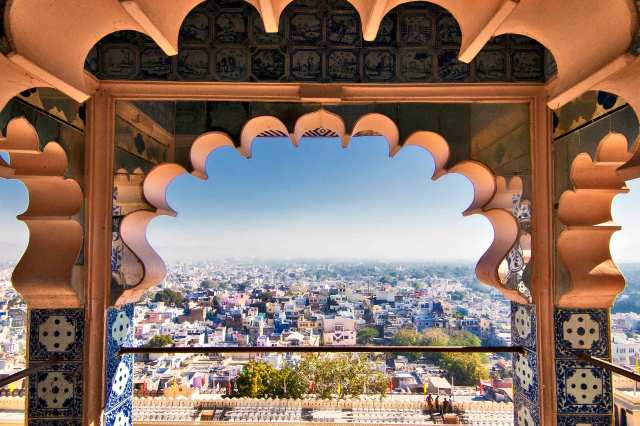

Innovation, reform, and restless energy are propelling the modernization of India’s economy.

How India is leveraging government reforms and innovation to position itself to deliver strong economic and earnings growth.

China’s latest stimulus measures could be the catalyst needed to restore confidence and unlock value in its equity markets.

The drivers of emerging market equity returns are evolving as innovation and economic decoupling join favorable demographics as future sources of excess returns.