Janus Henderson Investors

We believe in sharing insights from our Janus Henderson’s investment experts to help you navigate market trends and portfolio opportunities.

Articles Written

Market moves & themes that mattered: January 2026

A monthly market update featuring global equity and fixed income performance, sector and asset class trends, and key themes shaping the investment landscape.

Trump in 2026: Investment considerations for U.S. affordability and foreign policy

As the Trump administration enters its second year with a focus on affordability, investors must consider what the president’s latest policies will mean for markets.

Research in focus: Quarterly sector update

The fourth quarter of 2025 featured powerful secular themes that the Research Team believes will continue to create compelling opportunities across sectors in the year ahead.

Market moves & themes that mattered: December 2025

A monthly market update featuring global equity and fixed income performance, sector and asset class trends, and key themes shaping the investment landscape.

Research Sector Update: Encouraged by numerous secular growth trends

The third quarter highlighted various secular trends that could potentially set the stage for long-term earnings growth.

Research sector update: Navigating near-term volatility

Uncertainty about the outlook for AI spending and trade have made focusing on corporate fundamentals all the more important.

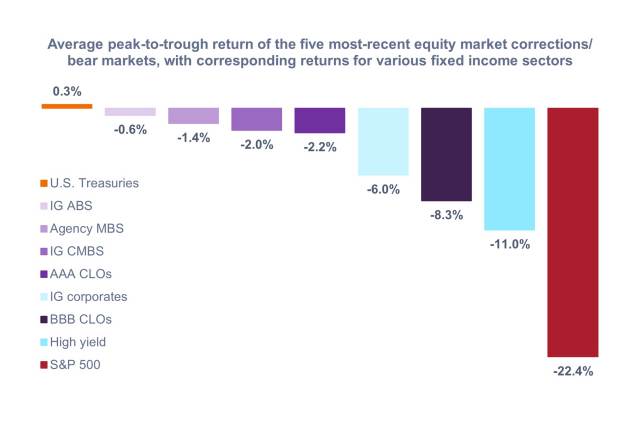

Chart to Watch: U.S. securitized fixed income’s performance through recent market corrections

For investors who are relatively new to securitized fixed income, recent market volatility may have provided the first opportunity to witness how securitized sectors might respond when equity markets pull back.

Trump tariff-led volatility: Investment lessons learned

With Trump’s tariffs reshaping global trade, our portfolio managers share insights on the longer-term implications for financial markets.

A diversifying opportunity: The case for small cap investing

Can an allocation to smaller companies help investors to capitalise on the ongoing shifts in global supply chains?

Widening the lens: Revisiting the case for non-U.S. stocks

After more than a decade of outperformance, U.S. stocks have come to dominate many equity portfolios.

A new set of winners: Actively navigating a broadening market

With U.S. equity leadership broadening beyond mega-cap stocks, active management offers a path to uncover tomorrow’s winners while managing passive investment concentration risks.

Fixed income outlook: Step back and mind the gap

How rail announcements offer insights into fixed income markets.