Research in Focus: Fast food companies down, but not out

Portfolio Manager and Research Analyst Joshua Cummings, from the Global Research Team, says that while inflation-weary consumers are pushing back against the price of fast food today, the industry’s long-term prospects still appear strong.

3 minute read

Key takeaways:

- For some fast-food chains, sales growth has decelerated in recent months as rising menu prices stoke the ire of inflation-weary consumers.

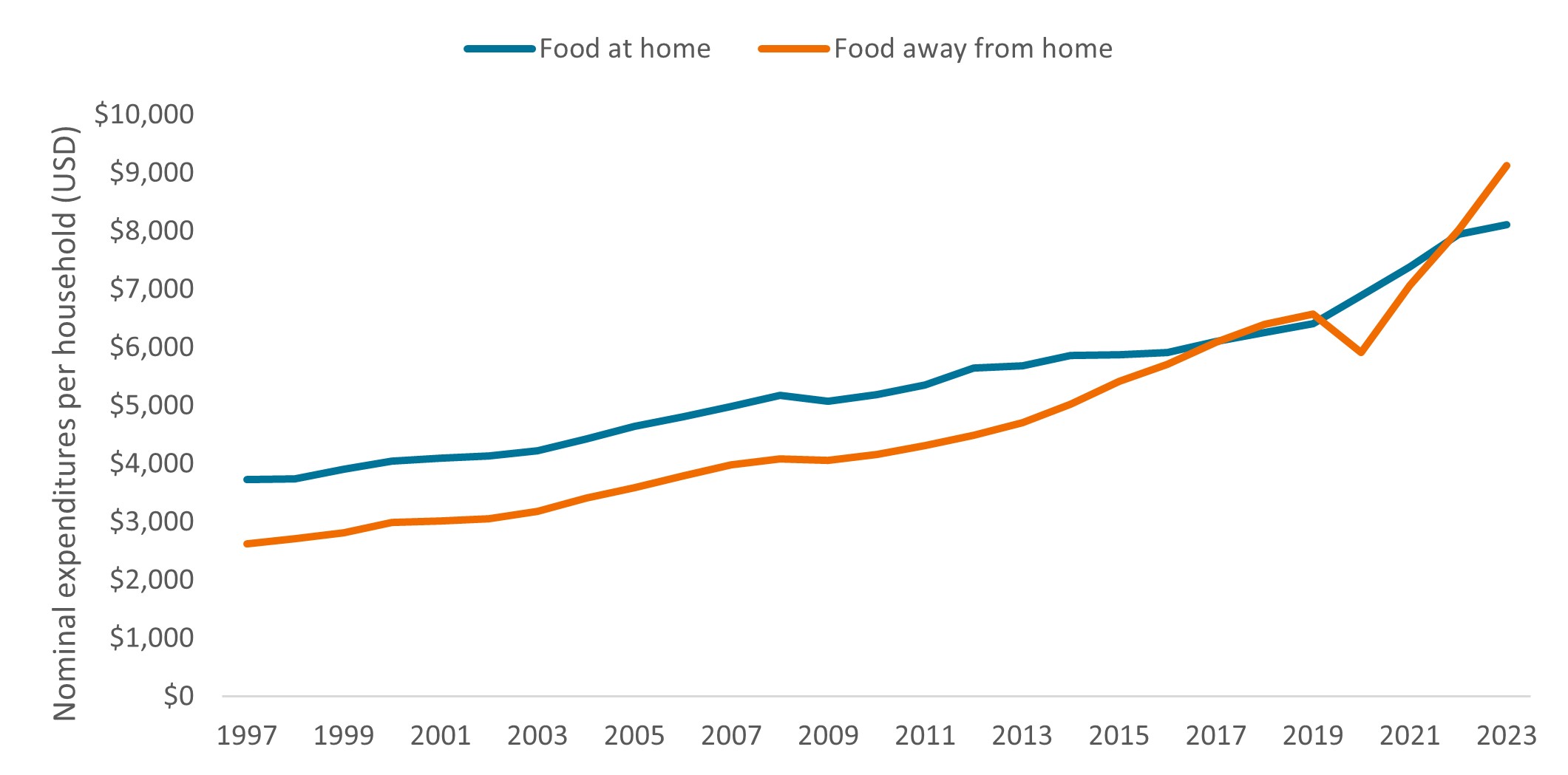

- However, some of the pushback reported in headlines and on social media is likely exaggerated given that prices for food at home and food away from home have moved largely in tandem since 2019.

- What’s more, data suggest food away from home continues to gain share from at-home eating on a structural/generational basis, which could create an opportunity for investors focused on the long term.

In a time of elevated inflation, anyone might reasonably think the fast-food industry would thrive as consumers seek out low-cost dining options. But judging by recent headlines and viral social media posts, these days, even fast food is getting pushback from cash-strapped consumers. “Americans are choking on surging fast-food prices,” said one news report in May. “$18 Big Mac meals,” exclaimed another headline, followed by social media posts purporting the famous hamburger deal now costs 100% more than it did five years ago.

The furor became so deafening that in late May, Joe Erlinger, president of McDonald’s USA, felt compelled to write a “Myth vs. Facts” blog post, defending the fast food chain’s price increases. (Fact: the average Big Mac Meal is now $9.29, up only 27% from 2019.1)

Even so, the damage has been done: During the latest quarterly reporting period, many fast-food chains reported a decline in year-over-year same-store sales growth. Their stocks have also lagged the broader equity market in 2024. And to win back customers, many companies are rolling out new value deals and adopting a “street-fighting mentality to win.”

Investor takeaway

In our view, the fast-food saga signals that more households are beginning to feel the cumulative impact of nearly three years of above-average inflation. Whether $5 value deals and other promotions will be enough to win them back in the short term remains to be seen.

But we’d encourage investors to also consider longer-term trends and remember that business fundamentals – not headlines – tend to matter more to companies’ long-term prospects. Over the last few months, the annual rate of inflation in the U.S. for food away from home (FAFH) has exceeded that of food at home (FAH), but since the pandemic, price increases in the two categories have largely kept pace (albeit with exceptions in some regions due to factors such as local minimum wage laws).2 And eating out has always been more expensive than FAH regardless of the inflation backdrop.

Furthermore, data show that when looking at long-term patterns, consumers are increasingly choosing to dine out. The average household spent more on FAFH as a portion of their overall food budget for the first time starting in 2018. And that percentage – with the exception of 2020, during pandemic lockdowns – has continued to climb since (See “By the numbers”). To that end, while growth has recently slowed for some companies, sales are still well above where they were before the pandemic, allowing firms to boast double-digit operating margins.

Will inflation reverse this trend? In a recent survey, nearly 80% of Americans said fast food is now a luxury because of price increases. But three-quarters of respondents also said they eat fast food at least once a week, and nearly half said they use store apps to unlock deals.3 In our view, these data points suggest fast food enterprises that are perceived to offer “value” – whether through loyalty programs, new menu items, quick service, and so on – have room for further growth.

Geography could also come into play: One popular fast-casual restaurant serving up burritos still has 99% of its stores in the U.S. It is among the most popular fast food options with Americans, and while management has plans to nearly double the domestic footprint, they are also eyeing non-U.S. expansion. In our view, that suggests opportunity for significantly more – not less – growth ahead.

By the numbers – U.S. household spending on food at home vs. away from home

Source: Calculated by U.S. Department of Agriculture, Economic Research Service from various sources. As of 3 June 2024.

1 Erlinger, Joe. “Providing meaningful value to our fans, with a side of facts” (McDonald’s, 29 May 2024).

2 U.S. Department of Agriculture, from January 2020 to April 2024.

3 Schulz, Matt. “Nearly 80% of Americans Say Fast Food Is Now a Luxury Because It’s Become So Expensive” (LendingTree, 20 May 2024).

All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect. The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Whilst Janus Henderson believe that the information is correct at the date of publication, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson to any end users for any action taken on the basis of this information.