JH Explorer in Canada: Progress check on miners enabling decarbonisation

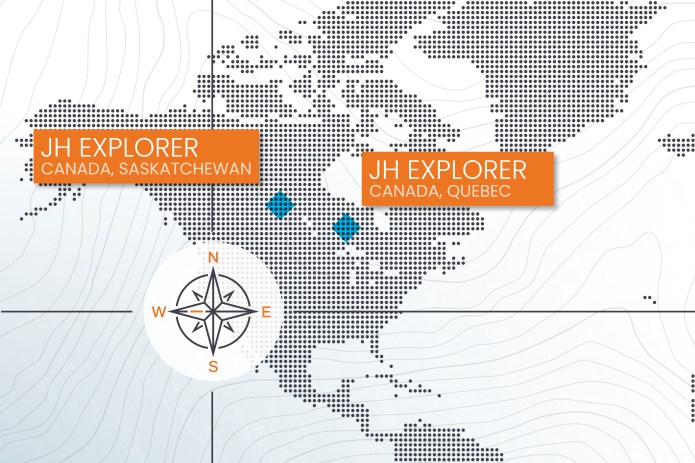

Portfolio Analyst Tim Gerrard shares his key findings from site visits to several iron ore and uranium mining projects in Quebec and Saskatchewan.

6 minute read

Key takeaways:

- The critical minerals enabling decarbonisation like iron ore and uranium are facing unprecedented demand. Government support from natural resources rich countries like Canada are critical to achieving a global low-carbon economy.

- Our research trips allowed us to see first-hand the developments of on-the-ground operations, providing valuable insight and supporting our conviction for portfolio companies.

- Active management is essential to navigate a complex sector like natural resources, to deliver potentially higher returns for investors, as well as manage risk.

| The JH Explorer series follows our investment teams across the globe and shares their on-the-ground research at a country and company level. |

Company research trips prove invaluable as on-the-ground insights helps us to get to know our portfolio companies better, while also being a means to cross-reference and validate industry views on competing companies. What’s more, they allow us to identify and monitor emerging trends within natural resources companies, as well as alert us to potential risks.

Relative to other countries, Canada is well advanced in its support of the critical minerals that are requisite to achieve the clean energy transition. A good example is the recent acknowledgement that high-grade iron ore is key to reducing carbon emissions from the steel sector, whose production is energy intensive and heavily reliant on coal. This initiative was announced by National Resources Canada, the government department responsible for among others, natural resources, energy, minerals and metals and forests.

Champion Iron – high grade iron ore

Coincidentally, the announcement that high purity iron ore was to be added to Canada’s critical mineral list occurred on the same day as our visit to Champion Iron’s operations at Bloom Lake, a 90-minute flight north of Montréal.

High grade iron ore has positive implications for the decarbonisation of the steel sector because it can be converted into pellet feedstock for Electric Arc Furnace (EAF) steel production, which has around a quarter of the carbon emissions of steel produced by traditional coal-fired blast furnaces. While Champion is subject to the daily gyrations of iron ore prices, in the long term its low-carbon intensity feedstock is likely to be highly sought after in the Middle East, Korea and Japan at premium prices. Additionally, the Canadian government’s announcement on high-grade iron ore should bode well for the proposed Kami project and potential to attract new joint-venture partners.

Iron ore haul truck at Champion Iron’s Bloom Lake property in northeastern Quebec

NexGen Energy – uranium

Next I travelled inland to Saskatoon and then it was a 90-minute flight north to Fort McMurray, followed by a 45-minute helicopter ride to NexGen Energy’s (NXE) world-class Arrow uranium project. NexGen is focused on developing the Rook I Project (including the high-grade Arrow deposit) into the largest, low-cost producing uranium mine globally, incorporating high levels of environmental and social governance.

Headed to Arrow – 1.5 hours by plane, then ¾ hour by helicopter

The camp was being expanded and when I arrived preparations for the construction of two new mine shafts were underway. The size of the Arrow mine’s footprint is impressively small, with a focus on carbon emissions monitoring, water use and waste management. And addressing of impacts on indigenous and local communities has been proactive, including benefit agreements, employment, education and wellbeing initiatives, which has seen the five native groups involved embracing the project. The clock is now ticking on government approval, so this circa C$2 billion project can finally get the green light some ten years after discovery. We visited the site of the new discovery just 3.5km away to the east, which could possibly be a mirror image of the Arrow project.

As an aside, if anyone is wondering why NexGen is a sponsor of the Aston Martin Formula 1 racing team, it’s because it provides an avenue to tap the funding and joint-venture potential of fellow race sponsors in the oil & gas sector. Some O&G companies may want to consider uranium rather than renewables as they look to diversify into low-carbon energy alternatives, with the bonus of typically having similar returns to oil & gas.

Camp at the Arrow uranium property

Here’s the Arrow discovery hole – which was made 10 years ago

Cameco – uranium

Uranium can play a significant role in the clean energy transition as it powers nuclear reactors, which have a minimal carbon footprint when compared to gas-powered generators. While prices of the metal have risen, the supply chain faces uncertainty given geopolitical risk (Russia is a key producer) and underinvestment in new mine projects. This means uranium miners like Cameco (which owns the world’s largest high-grade reserves with low-cost operations) are under a lot of pressure to maintain production levels over the long term. I continued my trip with a visit to Cameco’s headquarters in Saskatoon for a meeting with its CFO, Grant Isaacs. Cameco appears well positioned with its investment in Westinghouse Electric Company’s uranium services and fuels business. Meanwhile, its commitments to long-term contracts with current reserves should be able to meet customer needs as decarbonisation efforts ramp up. Cameco’s prospects of new investments in the AP1000 pressurised water reactor mega scale projects also look strong as another tailwind is US technology companies’ energy-intensive requirements to develop AI.

Active management helps to navigate a complex asset class

The natural resource industry is beholden to a plethora of factors like regulation, local community needs, supply issues, technology, required expertise and environmental constraints. But overriding that is the clean energy transition being a long-term tailwind for the companies involved in the supply and production of the critical minerals needed. As active investors, we believe our specialist expertise, experience, judgment and proactive company engagement can help to achieve potentially more attractive returns for our investors, as well as manage risk within our portfolios.

IMPORTANT INFORMATION

Commodities (such as oil, metals and agricultural products) and commodity-linked securities are subject to greater volatility and risk and may not be appropriate for all investors. Commodities are speculative and may be affected by factors including market movements, economic and political developments, supply and demand disruptions, weather, disease and embargoes.

Natural resources industries can be significantly affected by changes in natural resource supply and demand, energy and commodity prices, political and economic developments, environmental incidents, energy conservation and exploration projects.

Sustainable or Environmental, Social and Governance (ESG) investing considers factors beyond traditional financial analysis. This may limit available investments and cause performance and exposures to differ from, and potentially be more concentrated in certain areas than the broader market.

There is no guarantee that past trends will continue, or forecasts will be realised.

References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect. The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Whilst Janus Henderson believe that the information is correct at the date of publication, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson to any end users for any action taken on the basis of this information.