Inflation dilemma: where now for central banks and fixed income?

In this paper, Jim Cielinski, Global Head of Fixed Income, considers the potential pitfalls and impact on fixed income.

Key takeaways:

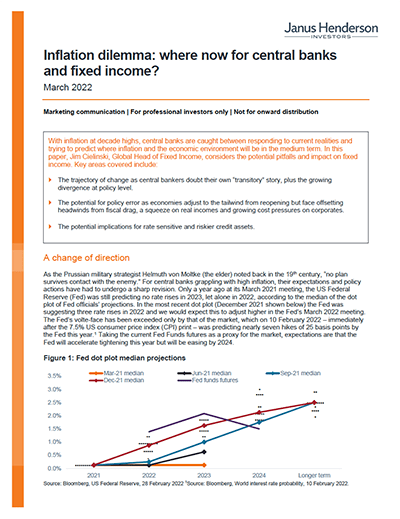

- The trajectory of change as central bankers doubt their own “transitory” story, plus the growing divergence at policy level.

- The potential for policy error as economies adjust to the tailwind from reopening but face offsetting headwinds from fiscal drag, a squeeze on real incomes and growing cost pressures on corporates.

- The potential implications for rate sensitive and riskier credit assets.

Download

JHI

All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect. The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Whilst Janus Henderson believe that the information is correct at the date of publication, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson to any end users for any action taken on the basis of this information.