Alternatives – all potential outcomes are on the table for 2025

David Elms, Head of Diversified Alternatives, discusses why he believes liquid alternatives can help to improve diversification in investors’ portfolios at a time when disruption might become the norm.

6 minute read

Key takeaways:

- Risk assets have performed well in 2024, which is influencing the shape of investors’ portfolios as we move into 2025.

- While we see room for further capital market gains, the market’s sanguine view on risk leaves the door open to unexpected shocks – a view that seems well suited to liquid alternatives.

- An allocation to alternatives can help to improve diversification, providing differentiated drivers of performance to help insulate against unexpected market stresses.

With 2024 turning out to be another bumper year for risk assets (at the time of writing), more enthusiastic investors might wonder if the argument for diversification still holds. With only six down years in the S&P 500 (total return index) thus far in the 21st Century, and with a cumulative return of 550% and an annualised return of 7.8% (1 Jan 2000 to 25 Nov 2024), it is no surprise to see more hawkish voices relegated to the back of the class. Fear of missing out (FOMO) has influenced the shape of investors’ portfolios. But at what cost?

As we look ahead to 2025, politics is consuming a lot of attention. The high theatre of a divisive US election has seen markets react positively to a decisive outcome. We saw many risk assets taking a bid, in line with expectations for US market-friendly ‘expansionary’ policies and lighter regulation under a new (‘second term new’) administration. The idea being that it could make it easier for US companies to do business, whether that comes in the form of tax cuts or less regulation.

While equities have enjoyed a post-election boost, bond markets seem perhaps a bit more sceptical, reflecting uncertainty around debt and inflation in the US, particularly given the rhetoric around the President-elect’s tax cuts, which has led expectations for a ‘higher for longer’ rate environment. And this brings us to an important point as we head into 2025. There are winners and losers in every cycle, something that applies both in the ‘real world’ environment of politics and economies, and the changing fortunes of financial market assets, across equities, bonds – and alternatives.

Room for both extremes in 2025

There is, in our view, room for capital markets to fly, but also potential for greater risks – an outlook that seems well suited to liquid alternatives. On the positive side, the potential for merger arbitrage opportunities has improved. Merger and acquisition (M&A) activity continues to pick up from 2023 lows, following a period where high interest rates and tighter regulation have squeezed activity. Corporates have cash on their balance sheets, while new fund raises has left private equity sitting on a veritable mountain of dry powder. This is money that needs to be put to work to generate a return for investors, and with distributions to private equity clients at a decade low, the pressure is building, which bodes well for new issues.

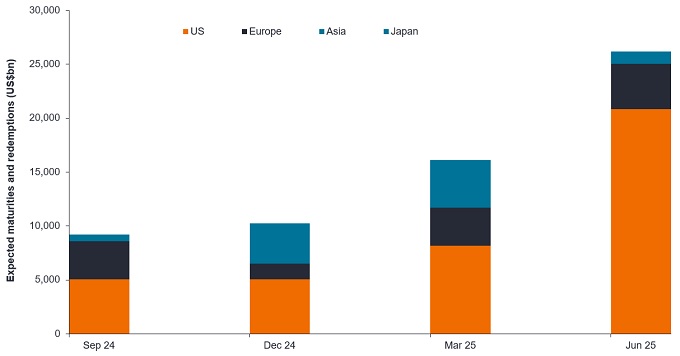

An environment of ‘higher for longer’ rates is also a favourable market dynamic for convertible bonds, which offer a funding advantage (lower coupon) for companies when it comes to refinancing debt. Issuance has steadily picked up from its low point in 2022, and with refinancing needs particularly acute in the US (and to a lesser extent, Europe). This is a trend that we expect to continue (Exhibit 1).

Exhibit 1: Higher refinancing needs is driving growing demand for convertible bonds

Source: BofA Merrill Lynch Global Research, ICE Data Indices, LLC, Bloomberg, Janus Henderson Investors analysis. Forecasts, as at 30 June 2024. There is no guarantee that past trends will continue, or forecasts will be realised. Past performance does not predict future returns.

Less positively, the market’s sanguine view on risk leaves the door open to unexpected shocks – which we have seen display already as unusual short, sharp ‘lightning strike’ moments. For example, a confluence of events saw a spike in panic on 5 August 2024. As investors rushed to unwind some huge leveraged positions in equity and currency markets, it sparked fears on the yen-funded carry trade in Japan, which saw the TOPIX plummet over 12% on the same day – the biggest one-day fall this century. This in turn triggered the largest single intra-day move in the VIX Index.

In September, we saw dominant AI chip supplier NVIDIA break all records for the largest single day loss for a US-listed company, with c. US$280bn wiped from its valuation over concerns about the progress and cost of artificial intelligence (AI) development. It is worth noting that of the S&P 500’s six down years this century, three of these came in succession between 2000 and 2002, when the dot.com bubble burst and the S&P 500 TR Index declined by approximately 35%.

While it was remarkable how quickly markets have recovered from recent shocks (and bringing into question the VIX’s role as the “fear gauge”) the question remains. If a more significant storm hits, are investors prepared for the outcome? Investors have relied for a long time on the negative correlation between equities and bonds as a primary source of diversification. The Darwinian environment has proved them right. But if we look back across much of the last century, they were not.

Exhibit 2: Equities and bonds – still natural diversification?

Source: Bloomberg, Janus Henderson Investors analysis, as at 31 August 2024. Rolling 12-month correlations based on monthly data for the S&P 500 Index and US 10-year government bonds. Past performance does not predict future returns.

Look for opportunity, prepare for uncertainty

We are moving into an era where disruption might become the norm, which leads us to believe that the spread of potential outcomes is huge. The US election has been good for risk assets, and crypto is on a major euphoria high – that will need follow-through from government policy to sustain. But the rest of the world still matters. Geopolitical uncertainty looks set to continue, and investors might need to think in new ways to deal with this environment.

A question to ask is if we get an inflation scare (thinking it is under control), and we see a 2022 environment where equities and fixed income are positively correlated and falling in value (perhaps triggered by a new era of ‘beggar thy neighbour’ trade and tariff policies) – how is your portfolio going to perform? In our view, it is more important than ever, despite sustained risk-on sentiment, for investors to stick with diversification.

An allocation to liquid alternative alternatives can help to improve diversification, offering genuinely differentiated drivers of performance to help offset the risk of positive correlation from equities and bonds during periods of market stress, or should lightning strike more often. As we look ahead to 2025, there are still plenty of opportunities for investors, but we see the argument favouring a much more balanced approach to risk, and a broader toolset to match.

Past performance does not predict future returns.

Balance sheet: A financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time. Each segment gives investors an idea as to what the company owns and owes, as well as the amount invested by shareholders. It is called a balance sheet because of the accounting equation: assets = liabilities + shareholders’ equity.

Capital markets: The part of a financial system concerned with raising capital by trading in shares, bonds, and other long-term investments.

Carry trade: At a simplified level, carry trade is a strategy that involves borrowing at a low interest rate and reinvesting in a currency or financial product with a higher rate of return, with the purpose of profiting from the difference.

Convertible bonds: A type of loan that yields investment dividends, with the additional benefit of being able to convert into a pre-determined amount of stock (shares) at various points in the life cycle of the bond, usually at the bondholder’s discretion.

Diversification: A way of spreading risk by mixing different types of assets/asset classes in a portfolio, on the assumption that these assets will behave differently in any given scenario. Assets with low correlation should provide the most diversification.

Inflation: The rate at which the prices of goods and services are rising in an economy. The Consumer Price Index (CPI) and Retail Price Index (RPI) are two common measures.

Liquid alternatives: An investment that is not included among the traditional asset classes of equities, bonds or cash, such as property or infrastructure, hedge funds, commodities, private equity, art, derivatives, or cryptocurrencies.

Merger arbitrage: The practice of simultaneously buying and selling of the stocks of two companies going through a merger, in order to profit from a difference in price.

Private equity: An investment in a company that is not listed on a stock exchange. Like infrastructure investing, it tends to involve investors committing large amounts of money for long periods of time.

Risk/risk assets: Assets generally perceived as displaying a higher level of potential volatility can be referred to as risk assets, including equities, commodities, or higher-yielding bonds.

TOPIX: The Tokyo Stock Price Index (TOPIX) is a capitalisation-weighted index of the largest companies (the ‘First Section’) listed on the Tokyo Stock Exchange. Given the number of companies it covers, it is generally regarded as a leading benchmark for Japanese stock prices.

VIX Index: The CBOE Volatility Index (VIX) is a real-time index that indicates the market’s expectations for short-term price changes on the S&P 500® Index, often known as the ‘fear’ index.

The S&P 500® Index reflects U.S. large-cap equity performance and represents broad US equity market performance.

All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect. The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Whilst Janus Henderson believe that the information is correct at the date of publication, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson to any end users for any action taken on the basis of this information.