An options-implied analysis of the US presidential election – Part III

In part three of a series on the U.S. presidential election, Head of Asset Allocation Ashwin Alankar explains how options markets are likely better indicators of an election’s potential outcome than polling data.

3 minute read

Key takeaways:

- Echoing polling data, which are largely within their margin of error, information within options markets indicates an extremely close race, with former President Trump recently gaining the slightest of edges.

- We believe options prices can contain powerful signals on an election’s potential outcome, as there is a cost to being wrong, and options prices tend to incorporate a broader array of information than polling data.

- With only days remaining until the election, investors would be well served to consider options market signals not only for divining the election’s outcome but also over the longer term to gain insight on how the next administration’s policies could impact the economy.

With just days to go before the pivotal U.S. presidential election, analysts, pundits, and investors are seeking whatever information possible to determine which campaign has the upper hand. Most rely upon an array of polling data, which have lately had a dubious track record in predicting election outcomes. With a bit of creativity, we can use options market signals to gain insights into its view on which party is likely to prevail.

Pricing risk – to the upside and downside

The options market can be considered an insurance market on financial assets. Just like an insurance premium, the price of an option provides information about the expected future risk to an underlying asset. Moreover, rather than just identifying total risk, the options market distinguishes the good risk, or upside volatility of the asset, from the bad risk, or downside volatility. Accordingly, by looking at options prices, one can measure the attractiveness of an asset, such as a stock. Academic research shows that the ratio of upside to downside volatility has good forecast ability in determining the attractiveness of an asset.

Crowdsourced and hard data

We consider the forward-looking information derived from options signals efficient as they are based on the collective insights of thousands of market participants. In other words, it is a crowd-sourced information measure. And unlike polling or survey data, which is soft data, options estimates are hard data as they are based on investments, and there is a monetary cost to being wrong.

Over the past few months, we’ve leveraged the options market to seek insight into the U.S. presidential contest. By identifying a basket of stocks that is aligned with the Democratic party, we can use the options prices of these securities to estimate the attractiveness of the basket. We can then do the same with a Republican basket.

Fortunately, research firm Strategas has constructed such baskets, enabling us to gauge the movement in options prices on these stocks. If the attractiveness of the Democratic basket is greater than the Republican basket, the market implies a greater probability of a Democrat win, and vice versa. The magnitude of the differences in attractiveness should correlate to how much greater probability the options market is assigning to the win of one party versus another.

Priorities

In our analysis, the Democratic basket has exposures to climate-focused companies, technology companies (less protectionism), and healthcare, while the Republican basket has exposures to financials (less regulation), the defense industry, and fossil fuels.

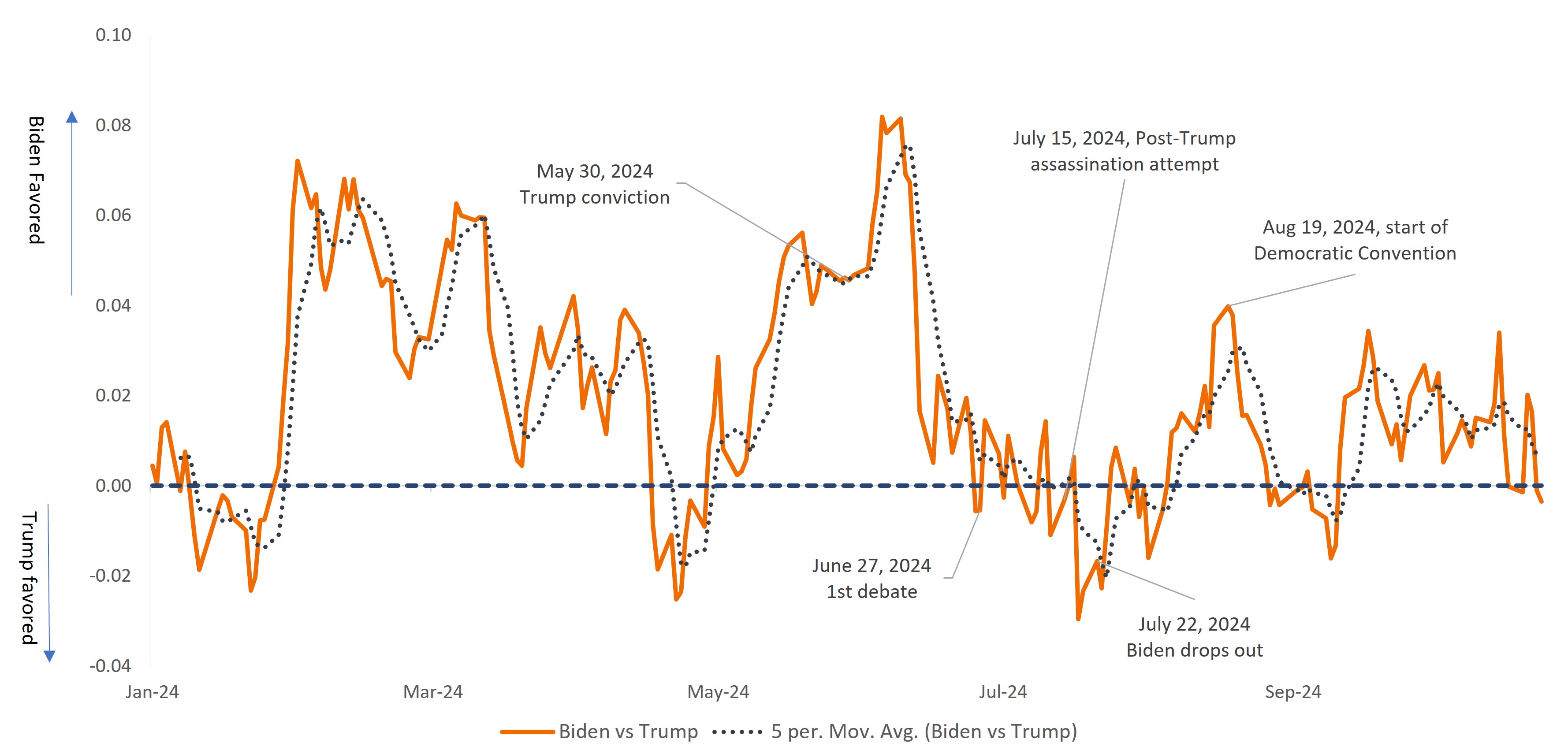

The chart below plots the difference in attractiveness between these two baskets and indicates the options market is very slightly favoring the Republican basket for a potential Trump win. For all intents and purposes, the options market sees the contest as a toss-up. An absolute difference larger than 0.05 would imply a quite strong view or conviction implied from options prices. Today we are far from this level.

Exhibit 1: Relationship of Democrat-to-Republican tail-Sharpe ratios

After a volatile campaign season, the upside potential for the Republican basket of options is slightly more favorable than the signals embedded in the Democrat basket.

Source: Strategas, Janus Henderson Investors, as at 25 October 2024.

IMPORTANT INFORMATION

Options (calls and puts) involve risks. Option trading can be speculative in nature and carries a substantial risk of loss.

Volatility measures risk using the dispersion of returns for a given investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- Emerging markets expose the Fund to higher volatility and greater risk of loss than developed markets; they are susceptible to adverse political and economic events, and may be less well regulated with less robust custody and settlement procedures.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.