Not out the woods yet: Multi-Asset viewpoint

Oliver Blackbourn, Portfolio Manager, and Adam Hetts, Global Head of Multi-Asset, consider what 2024 holds for investors and caution that there are still obstacles to clear before we are out of the woods.

8 minute read

Key takeaways:

- Expectations that the US economy would shrink in 2023 proved wrong, supported by resilient US consumer activity. However, with less money in the bank and tighter access to borrowing, there are questions about whether consumer spending resilience.

- Investors are pricing in interest rate cuts, although central banks remain alert for any stubbornness in inflation which could keep interest rates higher for longer.

- The path to a soft landing remains narrow, with the potential for significant volatility in markets should anything unexpected occur. In this environment, investors should ensure they have sufficient portfolio diversification.

The last few months of 2023 saw strong performance across many asset classes as markets priced in interest rate cuts, seemingly in the context of an expected ‘soft landing’, where the economy slows, but avoids recession and a sharp rise in unemployment.

Against this backdrop, both government bonds and risk assets, such as equities and corporate bonds, rallied as investors became convinced that we have reached peak interest rates. The rally took 2023 global equity returns, as represented by the MSCI AC World Total Return Index, to 22.8% in US dollar terms and 15.9% in sterling terms, as a more dovish outlook for the US Federal Reserve (Fed) weighed on the US dollar. Across corporate debt, credit spreads (the difference in yield between a corporate bond and a government bond of equal maturity) ended the year lower, with many areas at or close to 12-month lows. The late drop in bond yields meant that over the course of 2023 as a whole, the US 10-year Treasury yield was unchanged at 3.87%, completing a round trip from a high around 5% in October. The UK and German equivalents saw yields decline over the year.

A better-than-expected outcome

Going into 2023, the consensus forecast was for the US economy to shrink slightly but, ultimately, the economy is estimated to have grown by around 2.4% over the year, based on the latest surveys. As the largest economy in the world, the US sets the global tone. The US consumer continued to support growth as the labour market remained resilient. The unemployment rate remained historically low, below 4%, and the US economy overall continued to add new jobs at a solid pace. With real wages likely to improve as inflation returns towards the Fed’s 2% target rate in 2024, resilient consumer spending remains the key to a soft landing.

Not out of the woods yet

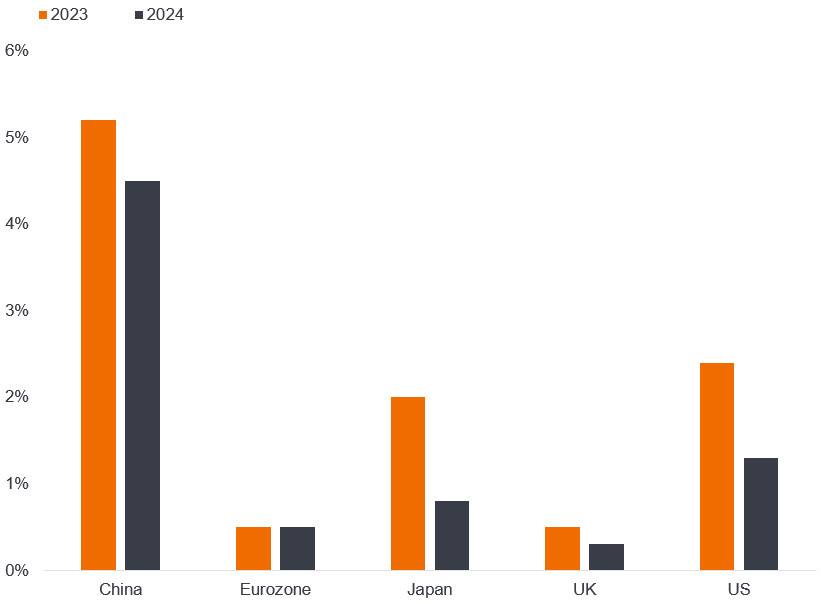

However, excess savings from the pandemic handouts have been run down and credit card debt has increased. With less money in the bank and tighter access to borrowing, there remain questions about whether spending can continue at the same pace. Similarly, companies have yet to see the full pass through of prior interest rate increases as many had fixed their debt costs for prolonged periods. Defaults (failing to meet debt repayments) have already started to rise among consumers and corporate borrowers. Debt levels that are lower than a decade ago suggest a crisis is not brewing, but there could be a significant drag on growth. Smaller companies are the backbone of US employment but will feel the most impact from higher borrowing costs. Consensus expectations are for average growth of 1.3% in the US this year, 0.5% in the Eurozone and only 0.3% in the UK.

Economic growth set to be slower in 2024

Source: Bloomberg, consensus economic forecasts, year-on-year change in real (inflation adjusted) gross domestic product. Figures as at 15 January 2024. There is no guarantee that past trends will continue, or forecasts will be realised.

Interest rate cuts coming

Investors have moved to price in very dovish expectations for major developed central banks. At the end of December 2023, expectations were that the Fed would make its first reduction in interest rates in March 2024, with 1.5% of cuts implied across the calendar year as a whole. A similar level of cuts was forecast for the European Central Bank (ECB) and a little more for the Bank of England (BoE).1 It is hard to see how markets price in a faster rate of loosening without a significant deterioration in growth expectations. A resilient US economy and continued elevated wage growth in the Eurozone and UK are likely to keep central banks on alert for any stubbornness in inflation and potentially keep interest rates higher for longer.

Very dovish pricing

Expectations for imminent and sustained interest rate cuts suggest a lot is already priced into government bond markets, unless we see concerns rising once more about the risk of a recession. The pace at which inflation moved lower in 2023 was sharp in a historical context and breakeven rates – an indicator of financial market expectations for inflation – are now indicating inflation levels over the next decade that are close to the level that central banks are targeting, to help maintain stable prices (around 2% for the US, UK and Eurozone).

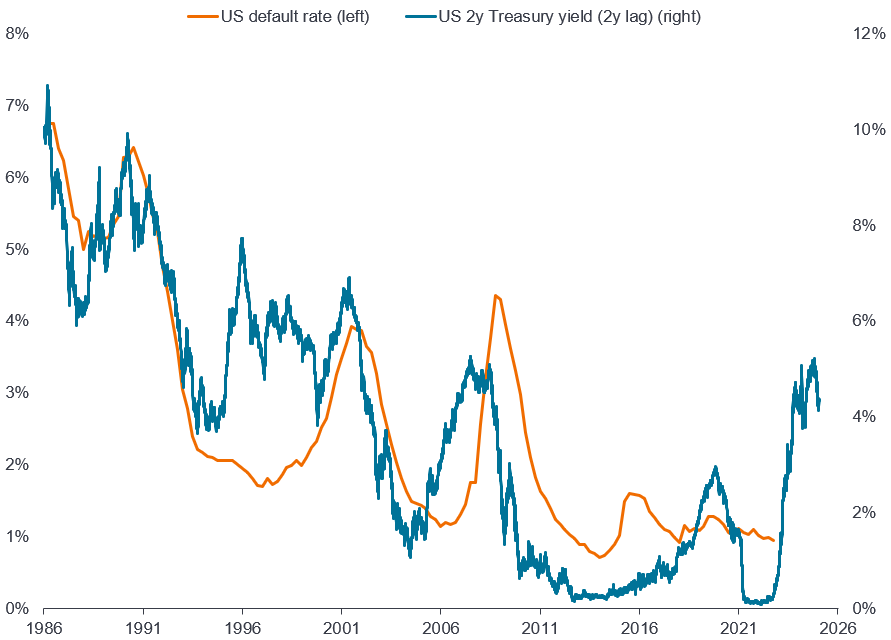

Corporate bond credit spreads at 12-month lows suggest limited concerns about downside risks, despite the lagged effects of monetary policy tightening (interest rates hikes) likely still feeding through into borrowing costs. Many better quality ‘investment grade’ companies had taken the opportunity to extend the maturity of their debt (the date at which loans are due to be repaid) ahead of the interest rate hiking cycle. But the high yield (lower quality) corporate debt and loans markets look more exposed, given the shorter duration (earlier repayment dates) of their liabilities and higher proportion of floating rate debt (debt where the interest payable is linked to a benchmark rate, such as inflation or market interest rates). Default rates among borrowers have already risen meaningfully from previous lows and there is no evidence that they have yet peaked.

Lagged effects of higher interest rates remain a concern for borrowers

Source: Bloomberg, Figures as at 18 January 2024. US economy-wide corporate delinquency rate. There is no guarantee that past trends will continue, or forecasts will be realised.

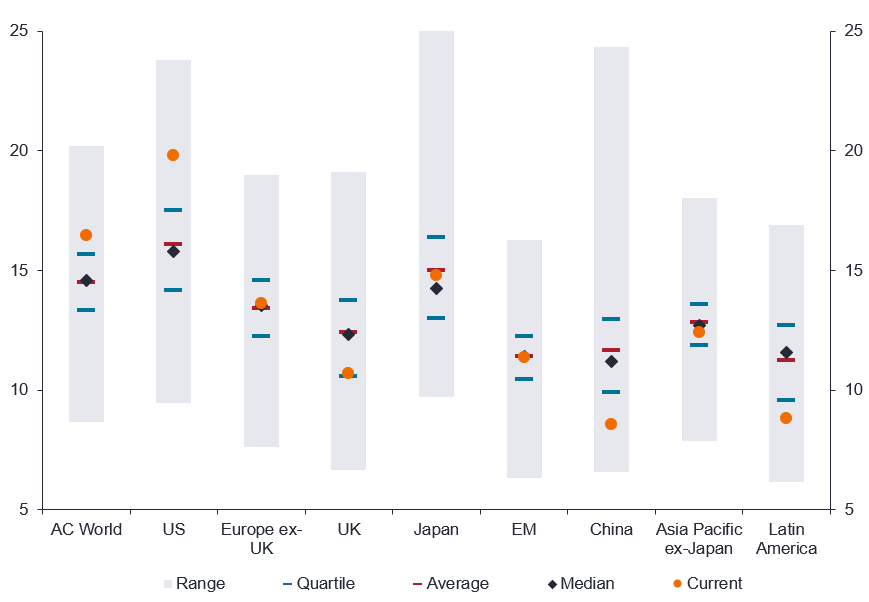

High expectations

Global equities currently look expensive in a broader context, but this is predominantly due to the high valuations of US stocks, particularly a small number of large growth stocks. Long-term earnings growth expectations for US companies have risen to very high levels, seemingly due to significant optimism around the future potential of Artificial Intelligence to drive earnings. However, the forecasts dramatically exceed historical growth rates and look hard to justify without a paradigm shift in productivity growth. More generally, global earnings expectations already price in a substantial rebound in economic activity at a time when economists predict a slowdown in 2024. It is difficult to see how both can be correct simultaneously.

Markets outside of the US and smaller US companies remain arguably cheaper and we believe could perform well on confirmation of a soft landing. Forecasts for earnings look less demanding and tend to be more cyclical. However, this can play both ways, meaning that a harder economic landing may still see significant downside, even if from a less expensive starting point. A switch to more dovish policies (interest rate cuts) could be particularly helpful for smaller companies that tend to be most sensitive to borrowing costs.

Price-to-earnings ratios of regional MSCI indices

Source: Datastream, Figures as at 23 January 2024. 12-month forward price-to-earnings ratios for MSCI regional equity indices. There is no guarantee that past trends will continue, or forecasts will be realised.

Risks in 2024

As we begin 2024, there is considerable uncertainty to add to the interest rate risks that markets have been focused on for the last two years. Geopolitical risks were features of 2022 and 2023, and violence in the Middle East and the potential for further escalation are likely to remain a concern for investors. The potential for a supply shock to global trade or energy markets remains an upside risk for inflation. Similarly, China continues to deal with the problems of a long-term build up in debt usage in key areas of the economy. Defaults from property developers, trust companies and potentially local government entities are sapping nascent investor sentiment, in the absence of a more concerted central government response.

Finally, over half of the global population will be eligible to vote in 2024. At a time when it feels like there is increased division, elevated government debt levels in developed economies and greater uncertainty about how to deal with many global challenges, there is the potential for markets to find some potential outcomes difficult to digest.

In terms of financial markets, the late 2023 market rally left many assets looking somewhat overbought, amid signs of investor exuberance. The path to a soft landing remains a narrow one, with deviation in either direction having the potential to cause significant volatility. Better-than-expected growth outcomes may delay interest rate cuts and weigh on valuations, but weaker data may raise the spectre of a hard landing. We believe investors need to be alert to incoming data and think about diversification in their portfolios.

Source for all yields, spreads and returns is LSEG Datastream, unless otherwise stated. Past performance does not predict future returns. Yields may vary over time and are not guaranteed.

1 Bloomberg, implied rate cuts using world interest rate probability projections, as at 31 December 2023. There is no guarantee that past trends will continue, or forecasts will be realised.

Bond yield: The level of income on a security, typically expressed as a percentage rate. For a bond, this is calculated as the coupon payment divided by the current bond price. Lower bond yields equate to higher bond prices.

Cyclical: Parts of the market or business that are more sensitive to changes in the economy.

Diversification: A way of spreading risk by mixing different types of assets/asset classes in a portfolio, on the assumption that these assets will behave differently in any given scenario.

Inflation: The rate at which the prices of goods and services are rising in an economy

Monetary policy: The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. Monetary policy tools include setting interest rates and controlling the supply of money. Monetary stimulus refers to a central bank increasing the supply of money and lowering borrowing costs. Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.

Price-to-earnings ration (PER, or P/E): A popular ratio used to value a company’s shares, compared to other stocks, or a benchmark index. It is calculated by dividing the current share price by its earnings per share.

Risk asset: Financial securities that may be subject to significant price movements (ie. carrying a greater degree of risk). Examples include equities, commodities, property lower-quality bonds or some currencies.

Volatility: The rate and extent at which the price of a portfolio, security or index, moves up and down.

Yield: The level of income on a security over a set period, typically expressed as a percentage rate. For equities, a common measure is the dividend yield, which divides recent dividend payments for each share by the share price. For a bond, this is calculated as the coupon payment divided by the current bond price.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers and narrowing indicate improving.

Volatility measures risk using the dispersion of returns for a given investment.

10-Year Treasury Yield is the interest rate on U.S. Treasury bonds that will mature 10 years from the date of purchase.