Many investors in European loans have been wondering about the prospect of a debt write-down at media and telecommunications giant Altice France (SFR) following the company’s underwhelming fourth quarter 2023 (and FY 2023) earnings call, which triggered substantial falls in the trading prices and quotes of its bonds and loans. The earnings call, on 20 March 2024, raised concerns about the over-levered company’s use of asset sale proceeds, as well as the spectre of debtholders being impaired as part of the company’s suddenly announced aim to reduce net leverage to a new target of below 4x (net debt to EBITDA).1

Further pressure on the company came in late March when S&P downgraded Altice France and its secured debt to CCC+ (CCC for Altice France Holding’s unsecured debt), citing, inter alia, weak credit metrics, weaker cash flow prospects, a growing interest burden and governance concerns.2

Greater dispersion of returns within loan market likely

While Altice France (encompassing Altice France S.A. and Altice France Holding S.A.) is the largest individual issuer of S&P-rated debt to European collateralized loan obligations, we see the wider market impact as rather limited.3 It is not a systemic problem for the European loans market.

That said, we do expect greater dispersion of returns within the European loan market due to a likely focus in the loan market on reducing exposure to over-levered credits in portfolios. We anticipate that we will see a repricing of risk, leading to possible price drawdowns of loans issued by companies that have large debt stacks coupled with weak operational performance.

Among the reasons why lower quality assets are unlikely to fare as well in 2024 as they did in 2023 are the following:

- Some of the highly levered names reliant on debt market financing may – whether due to M&A or capex programmes – need to issue new loans to meet liquidity needs. Amid increasing market focus on highly leveraged debt stacks, investors will likely demand that new issues reflect a more cautious risk pricing paradigm, in turn possibly leading to more stress on credit metrics. Investors are likely to remain cautious on large exposures rated B3, one step away from the riskiest C category (high risk of default).

- The increase in rates volatility since the beginning of the year – evident in the sharp rise in the MOVE Index in April and the significant back-up in 10-year government bond yields in 2024 after plunging to lows in late December 2023 – signals greater uncertainty for the financials of some highly leveraged corporates.4 The Swiss National Bank did cut its main interest rate by 25 basis points to 1.50% in March, but expectations around the US Federal Reserve (Fed) pivot in 2024 have been aggressively pared back (from expecting seven 25bps cuts to two or three). Similarly, the European Central Bank (ECB), on 11 April 2024, kept its key deposit unchanged at 4%. Although the ECB is expected to cut in June, there is generally now a relatively higher prospect of “higher-for-longer” policy rates, especially if oil prices rise further and global geopolitical tensions deteriorate. A higher-for-longer rate scenario is clearly negative for over levered companies, particularly those with a high percentage of floating-rate debt.

We believe that, along with lower correlation in returns across loans in 2024, investment strategies that can avoid price declines like Altice France will benefit in 2024.

What will drive returns in the loan market in 2024?

In 2023, we saw market participants reaching for risk, and lower-quality issuers rallying alongside high-quality names. In 2024, we see returns from the asset class continuing to be strong, largely driven by high coupons – in the region of 8%!5

Although defaults will likely pick up, they will still be contained, in our opinion. As of 29 February 2024, the trailing 12-month par default rate on the benchmark Credit Suisse Western Europe Leveraged Loan Index (CS WELLI) Index stood at 1.2%. Even if defaults rise to 3-4%, this still represents a manageable situation in an historical context.6

Investment outperformance in 2024 – relative to the CS WELLI Index – is likely to be driven by investment strategies that avoid distressed credits, excessive leverage and poor operating performance (i.e., credits that have not kept up with structural changes in the economy or have had poor business practices).

Positive return story intact

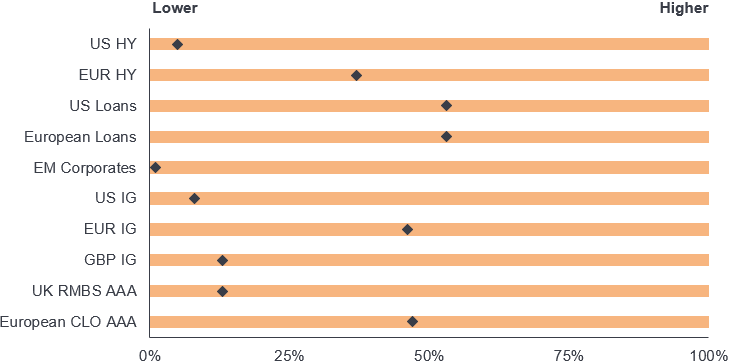

There are a number of reasons why we remain bullish on European loans. The first is relatively attractive spreads. In an asset class comparative context, valuations – if one compares the 4-year discount margin of loans to the z-spreads for fixed-rate corporates – continue to look reasonably attractive overall. Figure 1 shows spreads within a 10-year percentile ranking, as of 31 March 2024.

Figure 1: Loans attractive in a comparative spread context

Spread ranges – percentile rank (10-year look-back) as of 31 March 2024

Source: Janus Henderson Investors, Bloomberg, UBS/Credit Suisse, JP Morgan, Citi as of 31 March 2024. Note: Based on month-end spreads over previous 10 years. Fixed rate spreads are based on z-spreads; Floating rates indices based on discount margin. Indices used: Credit Suisse Western European Leveraged Loan Index, Credit Suisse Leveraged Loan Index, JP Morgan UK RMBS AAA 5y GBP, Bloomberg US Corporate High Yield Bond Index, Bloomberg Pan-European High Yield Index, Bloomberg EM USD Aggregate Corporate Index, Bloomberg Sterling Corporate Bond Index, Bloomberg US Corporate Bond Index, Bloomberg Euro-Aggregate Corporates Index. CLOs based on Citi Velocity European 1.0 AAA CLOs up to March 2013 then European 2.0 AAA CLOs thereafter.

A second reason is risk-adjusted returns. If one looks at the 3-year discount margin for Western European loans, and then factor in a default and recovery scenario worse than the current situation – defaults of 3.5% of which 50% is recovered – we still end up with a loss-adjusted excess return (above cash) of more than 3%.7 Clearly these are statistics for the European loan market as a whole and we, in the Loans team, would expect to register a lower level of defaults than the market given our selective positioning.

High coupons underpin positive outlook

The third reason for our bullishness is coupons. Loan prices have, admittedly, moved much closer to par as a whole compared to this time last year.8 The rally in high quality names over this period effectively means that in order to reach beyond the average coupon yield, investors would have to reach further out for risk, which, in our view, appears imprudent at this juncture.

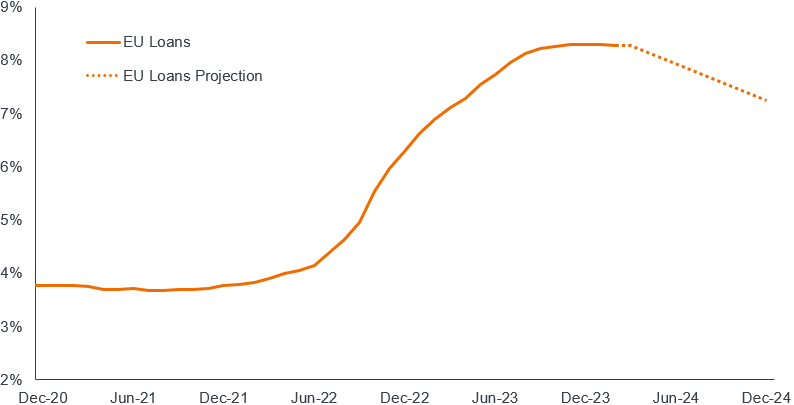

That means that returns will be largely driven by coupons. Fortunately, coupons are high and continue to make for a strong return story. Even with rate cuts, we foresee coupons remaining high. Figure 2 shows the evolution of loan coupons.

Figure 2: Loan coupons still look attractive

Source: Bloomberg, ICE BAML, Credit Suisse data, and Janus Henderson projections. Data from 31 December 2020 to 28 February 2024. Note: There is no guarantee that past trends will continue, or forecasts will be realised. The views are subject to change without notice.

A fourth reason for our positive stance on loans is that they are a hedge against inflation – if it returns. Stubborn, or rising, inflation is clearly not a consensus view given moderating inflation data trends, but inflation remains a risk factor for fixed income credits. If, for example, oil prices rise further and central banks do raise rates, loan coupons will ratchet higher. Further, as we saw in 2022 and 2023, the real value of debt is eroded away as companies raise prices.

How we are positioning for success in 2024

Our current investment view takes a more defensive bent. Bearing in mind our afore-stated contention that the remainder of 2024 will see higher dispersion (decompression) in returns, with high-quality issues faring relatively better, our attention is on names with less highly levered cap stacks.

1 Consolidated gross debt at Altice France and Altice France Holding is €24 billion (Source: S&P Global Ratings, 28 March 2024). In S&P’s view, Altice France will – assuming EBITDA of around €3.5 billion – need to reduce debt by around €10 billion to achieve its new leverage target of below 4x.

2 According to S&P Global Ratings (28 March 2024), Altice France’s guidance to weaker-than-expected earnings and cash flow for 2024 means “still high S&P Global Ratings adjusted debt to EBITDA of about 7.0x, a tightening EBITDA cash interest coverage of 2.0x-2.2x, and a large deficit in reported free operating cash flow (FOCF) after leases.” According to Bloomberg Intelligence (28 March 2024), based on face-value profit guidance, leverage could spiral to 7.7x in 2025 as EBITDA continues to decline and free cash flow turns negative due to lower profitability and higher interest costs.

3 Source: S&P Global (27 March 2024). According to S&P Global Ratings, Altice’s debt features in 98% of the European CLOs that S&P rate.

4 Source: Bloomberg. The Move Index trended lower from 3 October 2023, reaching a low of 86.28 on 28 March 2024, but then spiked in April (113.29 as of 17 April 2024). The US 10-year Treasury yield stood at 4.57% on 18 April 2024, having hit a low of 3.79% on 27 December 2023. The German 10-year Bund yield rose to 2.45% on 18 April 2024 from a low point of 1.89% o 27 December 2023. In a similar vein, 10-year gilts in the UK stood at 4.23% on 18 April 2024, a remarkable retracement from the 3.43% level on 27 December 2023.

5 Source: Bloomberg, ICE BAML, Credit Suisse data, and Janus Henderson projections as of 28 February 2024. See Figure 2.

6 Source: Credit Suisse and Janus Henderson, as of 29 February 2024.

7 Source: Credit Suisse, Janus Henderson Investors analysis, as of 31 March 2024. Yields may vary and are not guaranteed. Past performance does not predict future returns.

8 For example, on 1 April 2023, the average loan price was 94.85, with 27.1% of loans priced above 98. As of 8 April 2024, the average loan price stood at 97.77, with 81.1% of loans priced above 98.

Cap stack (capital stack). The structure of all capital that is invested into a company. A capital stack, for example, could include senior debt, mezzanine debt, preferred equity and common equity.

Credit metrics. Numerical representations of a borrower’s financial stability and creditworthiness. Examples include a credit score, a debt-to-income ratio, an interest coverage ratio and a credit utilisation ratio.

Credit risk. The risk that a borrower will default on its contractual obligations to make the required interest payments or repay the loan. Anything that improves conditions for a company can help to lower credit risk.

Credit Suisse Western Europe Leveraged Loan Index (CSWELLI). The WELLI is designed to mirror the investable universe of the Western Europe leverage loan market. This index comprises loans denominated in US$ or Western European currencies, where the issuer has assets located in or revenues derived from Western Europe, or the loan represents assets in Western Europe, such as a loan denominated in a Western European currency.

Discount margin. Discount margin is a type of yield-spread calculation designed to estimate the average expected return of a variable-rate security.

Dispersion. Dispersion, also called variability or scatter, is the extent to which numerical data varies, or is likely to vary, about an average value.

EBITDA. Earnings before interest, tax, depreciation and amortisation (EBITDA) is a metric used to measure a company’s profitability net of expenses and associated costs, taxes or debts.

Levered (leverage). The use of borrowed funds (debt) with the aim of amplifying potential returns. If the return on an investment exceeds the cost of debt, a profit is likely realised. However, if a company’s investment (e.g., an acquisition) fails to deliver the envisaged capital gains/cash flow, the financial obligations relating to the borrowed funds (debt) can lead to significant losses, particularly if the company is highly levered. A company’s capital structure that contains even a portion of borrowed funds is still considered a levered firm.

MOVE Index. The MOVE index, short for “Merrill Option Volatility Estimate Index,” is a measure of expected short-term volatility in the US Treasury bond market.

Net leverage (or net leverage ratio). A key financial measure to assess the borrowing capacity of a corporate issuer. Calculated as net debt (total principal debt outstanding net of cash and cash equivalents) divided by adjusted EBITDA for the most recent four quarters.

Percentile. A statistical measure to express where an observation falls in a range of other observations. A 90th percentile data point, for example, is the value below which 90% of data points fall.

Senior secured. Secured and senior debt is debt that is paid first in the event a company runs into financial trouble.

Volatility. The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. The higher the volatility the higher the risk of the investment.

Important information

Past performance does not predict future returns. There is no guarantee that past trends will continue, or forecasts will be realised.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Beta measures the volatility of a security or portfolio relative to an index. Less than one means lower volatility than the index; more than one means greater volatility.