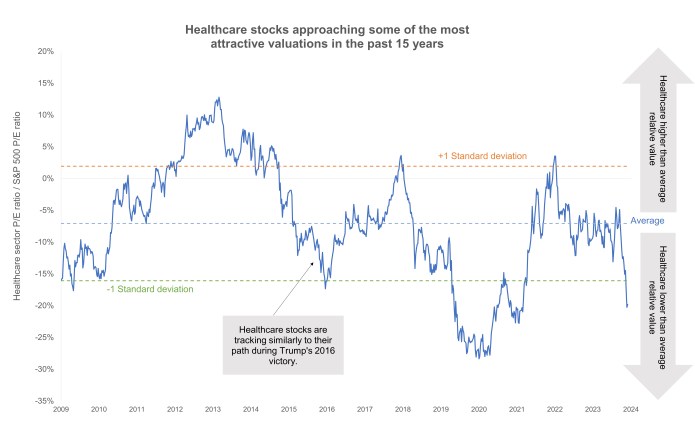

Chart to Watch: Healthcare valuations drop following Trump’s RFK Jr. pick

News that president-elect Donald Trump would seek to appoint Robert F. Kennedy (RFK) Jr. to lead the U.S. Department of Health and Human Services (HHS) is weighing on healthcare stocks, particularly biopharma companies. In the wake of the U.S. election, the healthcare sector is down 6% and biotech stocks are down 8% versus the S&P 500® Index.* The slide – which can be attributed to RFK Jr.’s controversial stance on healthcare policy – has healthcare valuations sitting at a discount relative to the broader market.

1 minute read

Key takeaways:

- RFK Jr., known for questioning the effectiveness of vaccines and wanting to divert resources from the National Institute of Health and the U.S. Food and Drug Administration (FDA), could be the next leader of the HHS. Trump’s appointment of RFK Jr. has widened the range of potential outcomes for the healthcare industry and created uncertainty for the market, resulting in near-term volatility.

- Investors should expect volatility to continue, especially if the appointment comes to fruition. However, RFK Jr.’s appointment is still subject to confirmation in the Senate (which is far from guaranteed), and we note that the reality of policy rarely matches campaign rhetoric.

- As investors await clarity, market moves could create buying opportunities for experienced healthcare investors, particularly given innovation from the sector continues to enhance the quality of patient care.

Source: Bloomberg, as of 22 November 2024.

We expect the volatility triggered by the news of RFK Jr.’s appointment to continue, but valuations versus the broader market are approaching some of the most attractive we’ve seen in the past 15 years. We view this as a unique opportunity to invest in healthcare and are carefully assessing buying opportunities. Ultimately, we believe a fundamental focus on innovation – a major theme driving growth in the sector – should be rewarded, regardless of the political backdrop.

– Andy Acker, CFA, Portfolio Manager

1Bloomberg, 6 November to 22 November 2024. Returns for the S&P 500 Index (3.3%), S&P 500 Health Care Sector (-2.5%), and NASDAQ Biotechnology Index (-4.8%).

NASDAQ Biotechnology Index is a stock market index made up of securities of NASDAQ-listed companies classified according to the Industry Classification Benchmark as either the Biotechnology or the Pharmaceutical industry.

Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

Volatility measures risk using the dispersion of returns for a given investment.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

IMPORTANT INFORMATION

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Health care industries are subject to government regulation and reimbursement rates, as well as government approval of products and services, which could have a significant effect on price and availability, and can be significantly affected by rapid obsolescence and patent expirations.