In a series of notes, we’ve explored the genesis of artificial intelligence (AI), the infrastructure required to support this revolutionary technology, and the functions in which it can be deployed to spur productivity in businesses and convenience in households.

One of the questions we addressed was whether AI’s potential would live up to the hype that began with OpenAI’s release of ChatGPT. While the mid-year sell-off in technology stocks may have suggested otherwise, we remain confident that AI has the potential to be a force multiplier for economic productivity and corporate earnings growth.

The short-lived correction of tech-focused indices – including names closely associated with AI – served as a reminder that equity markets are volatile, can be susceptible to a high degree of enthusiasm, and are vulnerable to macro and technical forces – in this case, the unwinding of a popular “growth trade” funded by the Japanese yen.

What the correction did not do was invalidate the powerful secular thesis underpinning AI. In fact, despite the ease with which earnings multiples compressed, we had not considered AI-related valuations particularly high prior to the sell-off. That’s because, unlike the late-1990s internet bubble, today’s investors can gain exposure to business models already capable of compounding earnings growth and generating cash – not merely the hope of eras past.

Furthermore, in our view, inevitable market pullbacks represent buying opportunities. Guiding this enthusiasm is the tech-sector maxim: The earnings potential of technological breakthroughs is typically overestimated in the near term while considerably underestimated over longer horizons. History illustrates that once the marketplace gains access to a new innovation, it can better determine how to best deploy it to increase efficiencies and grow revenues. For step-function technologies, growth has historically exceeded initial estimates.

Nevertheless, recent volatility provides us with the opportunity to close our AI series with an exploration of the risks involved in investing in this still-novel theme. By their nature, long-duration themes carry a degree of risk as investors attempt to assess market dynamics years in the future. Additionally, the AI theme carries a unique set of risks given its disruptive potential and concerns over negative outcomes associated with the notion of handing the keys to much of our everyday lives over to a machine.

Growing pains

As is the case with many technologies, AI’s rollout has been far from seamless. This has much to do with the transition from the training stage to the inference stage. Large language models (LLM) require massive data sets, and function-specific AI applications must train themselves by absorbing as much relevant information as possible. Early adopters of ChatGPT were quick to notice wrong answers and, in some cases, hallucinations, where the model appeared to have completely made something up.

But as previously discussed, the exponential growth of data available on the internet and of the computing power of advanced graphics processing units (GPUs) has resulted in LLMs and generative AI advancing along the training path more rapidly than many expected. We suspect this trend will continue in step with the computing power and data available.

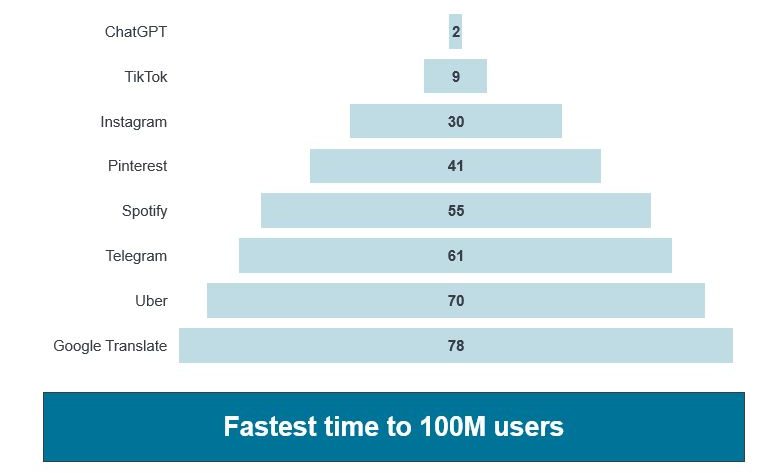

Exhibit 1: Months for an application to reach 100 million users

The productivity-enhancing nature of AI – with ChatGPT being just on example – coupled with its rapid adoption could translate to efficiencies being reaped across the global economy.

Source: Janus Henderson Investors, Yahoo Finance, as of 30 April 2024.

The inference stage will be the beneficiary of these growing pains. For many applications, that moment has already arrived, and AI can be deployed to complement humans seeking to reap efficiencies, improve the customer experience and, in many instances, assist in product discovery, including drug development.

Friend or foe?

The arrival of new technologies is often accompanied by fears of disintermediation, including job losses. Fortunately, these concerns have been largely unrealized as displaced jobs are supplanted with more value-added positions. The growth of the global middle class is testament to this. Still, given the degree to which AI could impact the services sector, policymakers must be mindful of balancing this catalyst to productivity that is needed in many developed economies with the often-overlooked step of ensuring populations are well-equipped for the 21st-century workplace. Failure to do so could create disruption far beyond the corporate sector.

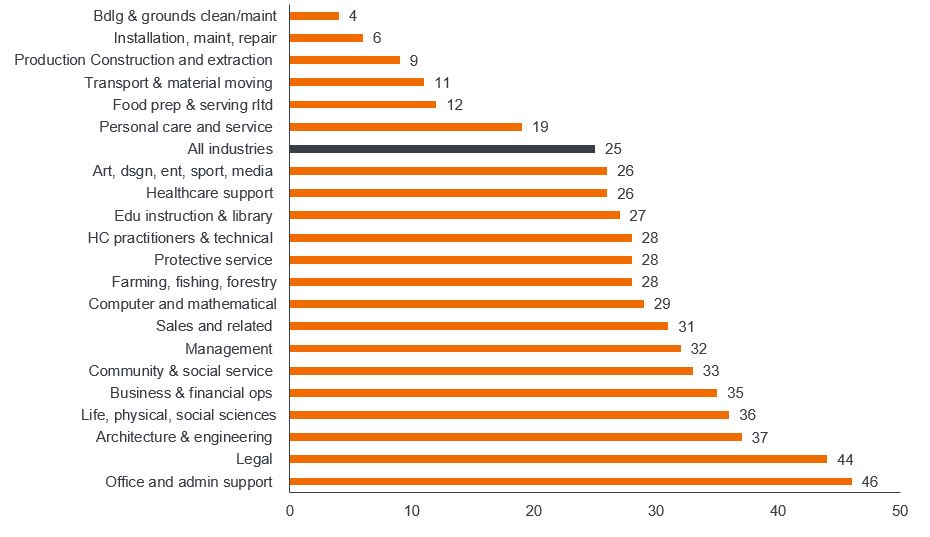

Exhibit 2: Professions at risk

The breadth in which AI can be used to streamline job functions means that policymakers and corporate leaders must be mindful about how to effectively deploy displaced workers.

Source: Tyna Eloundou, Sam Manning, Pamela Mishkin, and Daniel Rock. “GPTs and GPTs: An Early Look at the Labor Market Impact Potential of Large Language Models.” Open AI, OpenResearch, University of Pennsylvania. August 2023.

Perhaps more than with other recent technological advancements, the rollout of AI has significant geopolitical ramifications, with some characterizing it as an arms race between the U.S. and China. Consequently, moves have been made to restrict the flow of key technologies, including advanced GPUs. While it may be prudent for geopolitical spheres to ensure access to the building blocks of AI – and limit them for strategic competitors – such steps are a retreat from the free flow of goods and are therefore an inefficiency for which investors must account.

While parallel AI supply chains create multiple targets for investment capital (likely limited to sources within their geopolitical sphere), they are also inherently inflationary as global competition is suppressed. Furthermore, investors must understand the impact trade barriers will have on the quality of the competing AI platforms. Lack of access to the most advanced GPUs and capital equipment would invariably be a setback for companies and governments seeking to fortify their own AI platforms.

Similarly – and as has been the case before with “big tech” – policymakers may grow wary of these companies’ power and seek to impose regulatory impediments, which could adversely impact their business models and growth trajectories.

Other risks associated with the rollout of AI have more indirect financial implications but should nevertheless be on investors’ radars as they could tilt the environment toward more government oversight. Among these are so-called deep fakes by foreign actors and nefarious election influence. Deploying AI to replicate or steal proprietary technology and national security information are some of the most worrying potential uses, topped only by the risk of AI-enabled military systems, after running through a series of scenarios, launching a pre-emptive strike against an adversary. While remote, the mere existence of such possibilities means there is more work to be done to determine how man and machine will ultimately interface in such sensitive areas.

Balancing risk and return

Outside of these more remote scenarios, investors will more likely have to contend with risks more commonly associated with disruptive growth themes. In addition to the builders of AI infrastructure and creators of AI platforms, many companies have developed forward-looking strategies on how to integrate AI within their business vertical. Laggards, on the other hand, fail to recognize the magnitude of this sea change. We saw the recent pullback in AI-related valuations as a reset that allowed investors to acknowledge that, with any period of rapid technological transition, there will be a wide dispersion between winners and losers, and to position themselves accordingly.

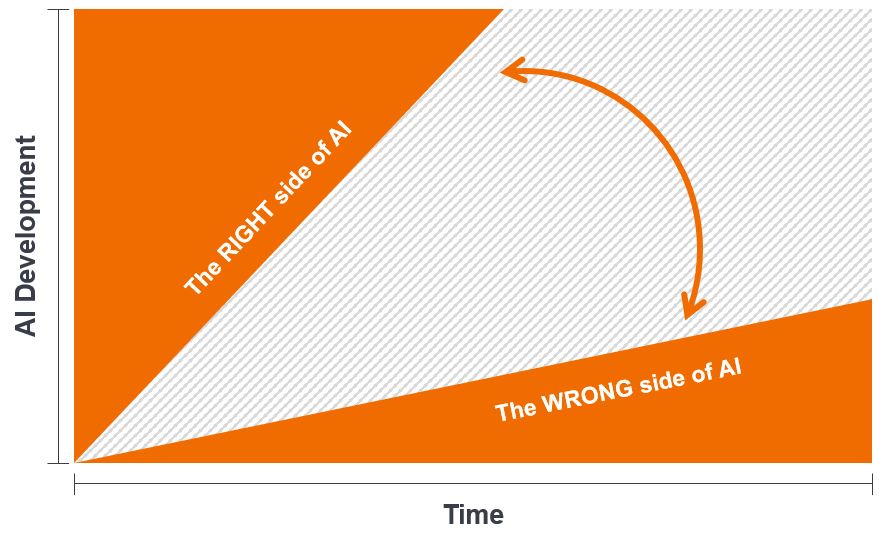

Exhibit 3: An extra layer of scrutiny

In addition to having to determine which companies will land on the winning side of the AI divide, investors must actively seek to understand regulatory and geopolitical risks to position themselves for optimizing exposure to this theme.

Source: Janus Henderson Investors.

Source: Janus Henderson Investors.

Earnings multiples – especially for growth stocks – tend to ebb and flow on factors ranging from the trajectory of interest rates to where we are in the economic cycle. Earnings, on the other hand, are a more effective barometer of a company’s promise. Unlike many secular growth themes, even in these early-to-middle innings, select companies are already delivering impressive earnings growth on the back of their AI initiatives.

Identifying these winners – along with quantifying the real risks described above – requires a level of due diligence that takes into account all technological, business-model, regulatory and geopolitical factors. The quick recovery of a concentrated equities market could seem to diminish the need to adhere to this approach, but over the arc of the AI theme’s rollout, it should in our view, prove to be the one most likely of harnessing this technology to generate excess returns.

IMPORTANT INFORMATION

Concentrated investments in a single sector, industry or region will be more susceptible to factors affecting that group and may be more volatile than less concentrated investments or the market as a whole.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.